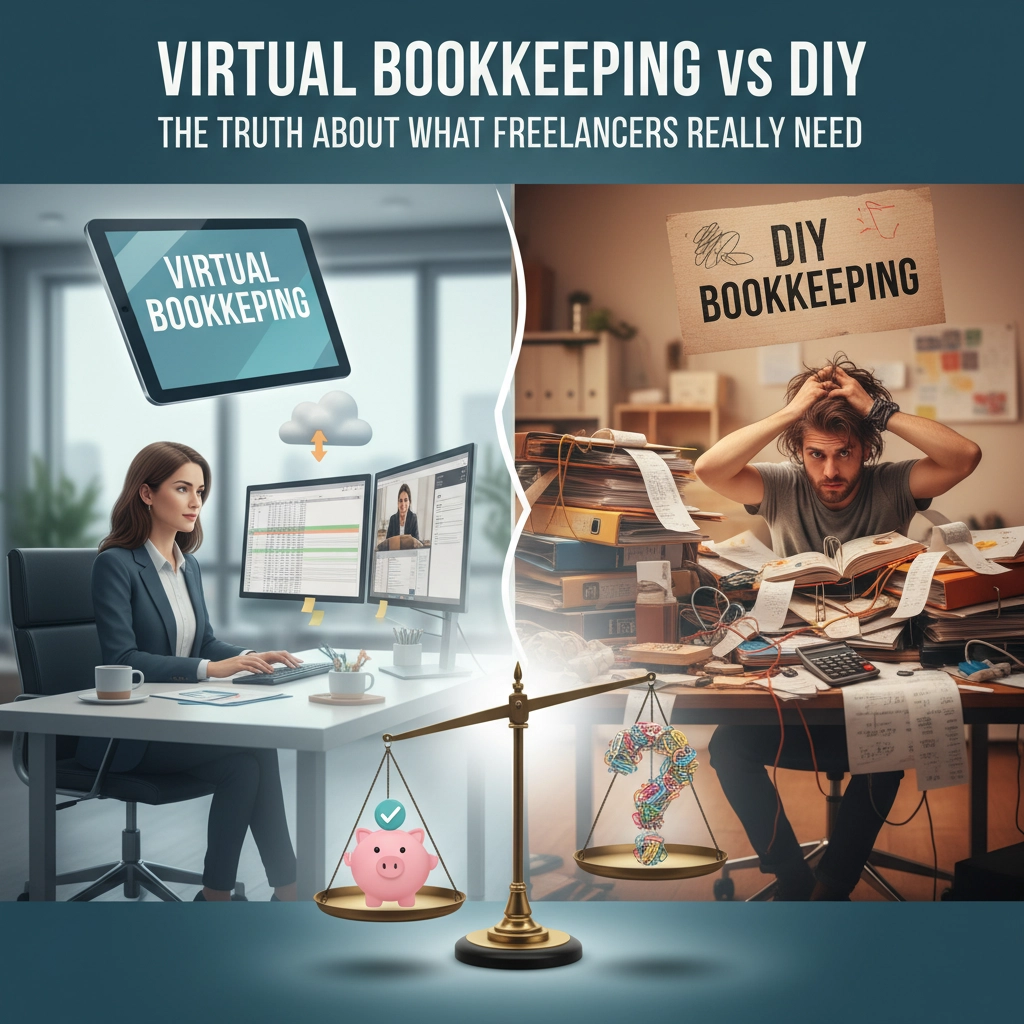

Let's be honest – as a freelancer, you probably didn't start your business because you love crunching numbers and categorizing expenses. You started it because you're amazing at what you do, whether that's writing, designing, consulting, or coding. But here you are, staring at a pile of receipts and wondering if you should handle your books yourself or pay someone else to do it.

This isn't just about saving money. It's about understanding where your time creates the most value and making a smart business decision that actually helps you grow.

The Real Deal with DIY Bookkeeping

Here's the thing about doing your own books: it can absolutely work, especially when you're starting out. If you're a new freelancer pulling in less than $50K a year, working with just a few clients, and your expenses are pretty straightforward, DIY might be perfect for you right now.

The appeal is obvious – you save money and stay in complete control of your financial data. Plus, when you handle your own bookkeeping, you really get to know your business's cash flow patterns. You'll spot trends, understand your busy seasons, and have your finger on the pulse of every dollar coming in and going out.

Simple tools can handle straightforward setups just fine. If you actually enjoy organizing financial stuff and have time to dedicate to it regularly, DIY could be your jam.

But – and this is a big but – the hidden costs of DIY often bite you where it hurts. Missed tax deductions, late payment penalties because you forgot to invoice someone, and hours spent manually entering data can easily cost you more than professional help would. Plus, you're flying solo when it comes to catching errors, staying compliant with tax rules, and making sure everything's accurate.

One freelance designer I know spent three days trying to figure out why her books didn't balance, only to discover she'd been categorizing client reimbursements as income. That mistake could have cost her big time come tax season.

What Virtual Bookkeeping Actually Gets You

Virtual bookkeeping is exactly what it sounds like – professional bookkeepers who work remotely to manage your financial records. At BalanceWise Books, we offer personalized virtual bookkeeping help tailored to your needs – perfect for solopreneurs and freelancers who want simple, customized solutions. If you'd like details specific to your situation, reach out through our contact form and we'll walk you through options.

The biggest win? Time. Professional bookkeepers save you hours every month, improve accuracy, and often spot tax savings that DIY approaches miss completely. They know the rules, they catch mistakes before they become problems, and they keep your books current even when you're swamped with client work.

Here's where it gets really valuable: as your business gets more complex, virtual bookkeeping becomes almost essential. Multiple income streams, international clients, complicated expense categories, and software integrations – these things can turn DIY bookkeeping into a part-time job you never wanted.

Virtual bookkeeping also gives you something DIY can't: consistency. When you're handling your own books, what happens when you get slammed with client work for three months straight? Your bookkeeping falls behind. When you go on vacation? It waits for you. Professional services keep chugging along no matter what's happening in your life.

Let's Talk Real Numbers

Here's what matters most: opportunity cost. Every hour you spend reconciling bank statements or categorizing expenses is an hour you're not serving clients or growing your business.

Instead of focusing on software fees or hourly rates, consider the trade-offs: your time, accuracy, and peace of mind. If you want a simple way to offload the books without the overwhelm, BalanceWise Books can tailor support to your workflow – no one-size-fits-all approach.

When to Stick with DIY vs When to Make the Switch

Keep doing it yourself if:

- You're earning under $50K annually with simple income

- You have fewer than 50 transactions per month

- You work with just a handful of clients

- You genuinely don't mind (or actually enjoy) the financial management side

- You're still in the early stages of building your business

Time to invest in virtual bookkeeping when:

- Your annual income hits $75K or more

- You're juggling multiple income streams or international clients

- You regularly have 100+ transactions per month

- Your hourly rate makes bookkeeping time ridiculously expensive

- You're consistently behind on your books

- Tax season stresses you out every single year

- You're trying to scale and need reliable financial reporting

There's also a middle-ground option worth considering: using paid bookkeeping software for day-to-day stuff but having a professional handle your taxes annually. This gives you control over daily entries while ensuring expert review when it matters most.

Making the Smart Choice for Your Business

Here's what I've learned from talking to hundreds of freelancers: most successful ones eventually outgrow DIY bookkeeping. The question isn't really "if" you'll need to outsource, but "when."

The sweet spot seems to be around $60K-$75K in annual revenue. That's when the complexity usually increases enough that the time savings and accuracy improvements from professional services clearly justify the cost.

But don't wait until you're months behind and scrambling before tax deadlines. That's when you end up paying premium rates for catch-up services and dealing with unnecessary stress.

Do this calculation: figure out your effective hourly rate, estimate how many hours you spend monthly on bookkeeping, and compare that to what professional services would cost. If the math shows you're actually losing money by doing it yourself, the decision becomes pretty clear.

If you're ready to explore professional bookkeeping support, BalanceWise Books offers personalized virtual help tailored to your needs. Reach out through our contact form for more information.

The Bottom Line

Your expertise is in serving your clients, not in reconciling bank accounts. There's absolutely no shame in recognizing when it's time to delegate bookkeeping to someone who specializes in it.

Whether you choose DIY or virtual bookkeeping, the most important thing is that you choose consciously. Don't let your books fall behind because you couldn't decide. Don't overspend on services you don't need yet. And definitely don't underestimate the value of your own time.

The right choice depends on where your business is today and where you want it to be tomorrow. Just remember – as your freelance business grows and gets more complex, having solid, professional bookkeeping becomes less of a luxury and more of a necessity for sustainable growth.

If you're still not sure which direction makes sense for your specific situation, we'd love to help you figure it out. Get in touch with us and we can walk through your needs together.